Brexit agreement: the main changes as of 1 January 2021

Until the final moment before Brexit, it remained unclear if agreements would be made between the European Union and the United Kingdom that would facilitate a beneficial (trade) relationship. Just before 1 January 2021, the day the UK officially left the EU, an agreement was made between the two parties. This article explains the main changes that apply as a consequence of Brexit and the Brexit agreement.

-

Travelling from and to the United Kingdom

As of 1 January 2021 you will need –just as with other non EU countries- a passport or identity card to travel between an EU memberstate and the UK. If you are travelling from the EU and you want to stay in the UK for more than 90 days, you also must have a visa. And when crossing the border, there are formalities to be dealt with. This especially impacts the import and export of goods.

-

Import and export

Registration of goods

If you transport goods between the EU and the UK, than you have to register these at the British, as well as the European customs. In order to do so, you or your importer needs to have a so called EORI number. If you don't have one, you can compile one yourself, or apply for one at the tax authorities. Here you can read how to do this if your company is headquartered inside the Netherlands. If your company is established outside the EU (for example in the UK), you can read more about requesting an EORI-number here.

VAT

Do you import goods from the UK? Then you have to pay VAT over these goods, or you can make a VAT declaration. In order to shift VAT, you must apply for an Article 23 authorisation (in Dutch: vergunning artikel 23) at your tax office. If you export goods from the Netherlands to the UK, you must fill in the VAT over these goods at part 3a of your periodic VAT declaration.

Customs duties

When you import to, or export from a non EU country, you usually have to pay customs duties. But thanks to the Brexit agreement, you might be granted relief from import duties. And with export, you can also avoid that custom duties are imposed. Make sure you’ll Check* if you meet the conditions for indemnification. If you don’t meet the requirements, then you need to sort out what the amount of the custom duties on your goods is. You can find this with your commodity code on the website Access2Markets from the European Commission.

Licences and certificates

Due to Brexit, you might need licences of certificates with your goods, whereas you didn’t need these before. On the website of the Dutch customs, you’ll find an overview of customs authorisations, and information on how to arrange the paperwork needed. Do pay attention, there are many different authorisations, registration processes, permits, admissions and agreements. Figuring out what you need to do and arranging your transports correctly can be complex and time-consuming.

-

Services

Service industry in the UK

If you have a EU based company that offers services to the UK, Brexit may complicate your business. Possibly you are not able to fulfil all agreements made in your (long-term) contracts. That’s why parties that offer services to the UK are advised to sort out until what extend agreements must be adjusted. For example, working with a British partner or starting an establishment in the UK can be useful to prevent problems and continue your business.

VAT on services

As with import and export, you must be aware that VAT rates on services no longer fall under European legislation. Ergo: your VAT tariffs might have changed as from 2021. Make sure you check the tariff you must charge on services you deliver from the EU to the UK, and vice versa. If you deliver services to the Netherlands, it is likely that the VAT is reverse charged to the party receiving your service in the Netherlands.

Digital services

Due to Brexit, data streams in the UK are no longer part of the EU legislation. If you make use of these, or supply data to the UK, you probably have already made an analysis of the consequences of Brexit. If not, make sure you do so asap.

Did you previously made use of the MOSS scheme? Do note that the MOSS scheme is no longer applicable for EU entrepreneurs who deliver digital services to the UK. But the other way around; if you export digital services from the UK to an EU country, you can (still) make use of the advantages of MOSS.

Privacy: GDPR (AVG) legislation

The Brexit agreement holds into account that the transmission of personal date (GDPR, or in Dutch: AVG) will get disturbed when there is no transitional period. Therefor this will remain the same as before Brexit, until May 1st, 2021. If your business includes the transmission of personal data, keep track of the website of the Dutch DPA or (for more detailed information) the British ICO.

-

Employment and housing

Employees from the UK

Do you employ personel from the UK in the Netherlands? Or are you British and working in the Netherlands? Employees from the UK must be registered in the (Dutch/EU) municipality in which they are based. Furthermore, they must apply for a residence permit. You can read all about this on the website of the Dutch Immigration and Naturalisation Services. If British employees are located in an EU country after 1 January 2021, they also need a working permit. The employer applies for the permit at werk.nl.

Working in the UK

Do you have a Dutch passport and do you (live) and work in the UK? Or do you have Dutch personel based there? Make sure Dutch employees in the UK apply for a residence permit at the British government before the 31st of June 2021. If the employee was based in the UK before 1 January 2021, he or she falls under the withdrawal agreement and is permitted to continue working in the UK. After this date it is far less easy to work in the UK as a EU citizen.

Housing

If you come from an EU Member state and (want to) live in the UK, than you (and your family members) will need an residence permit because of Brexit. Make sure you apply for one

before the June 30, 2021 at the British government. When you have been living in the UK for over 5 years, you can get a settled status: it allows you to live and work in the UK and make use of public services. EU citizens who stayed in the UK shorter than 5 years may apply for a pre-settled status, which can be converted into a settled status after a 5 years stay in the UK. You can apply for a pre-settled status here.

In order to live in the UK after Brexit, you must meet high standards. After all, one of the main purposes of Brexit is to decrease immigration to the UK. If you get enough points in the ‘point immigration system’, you request may be authorised.

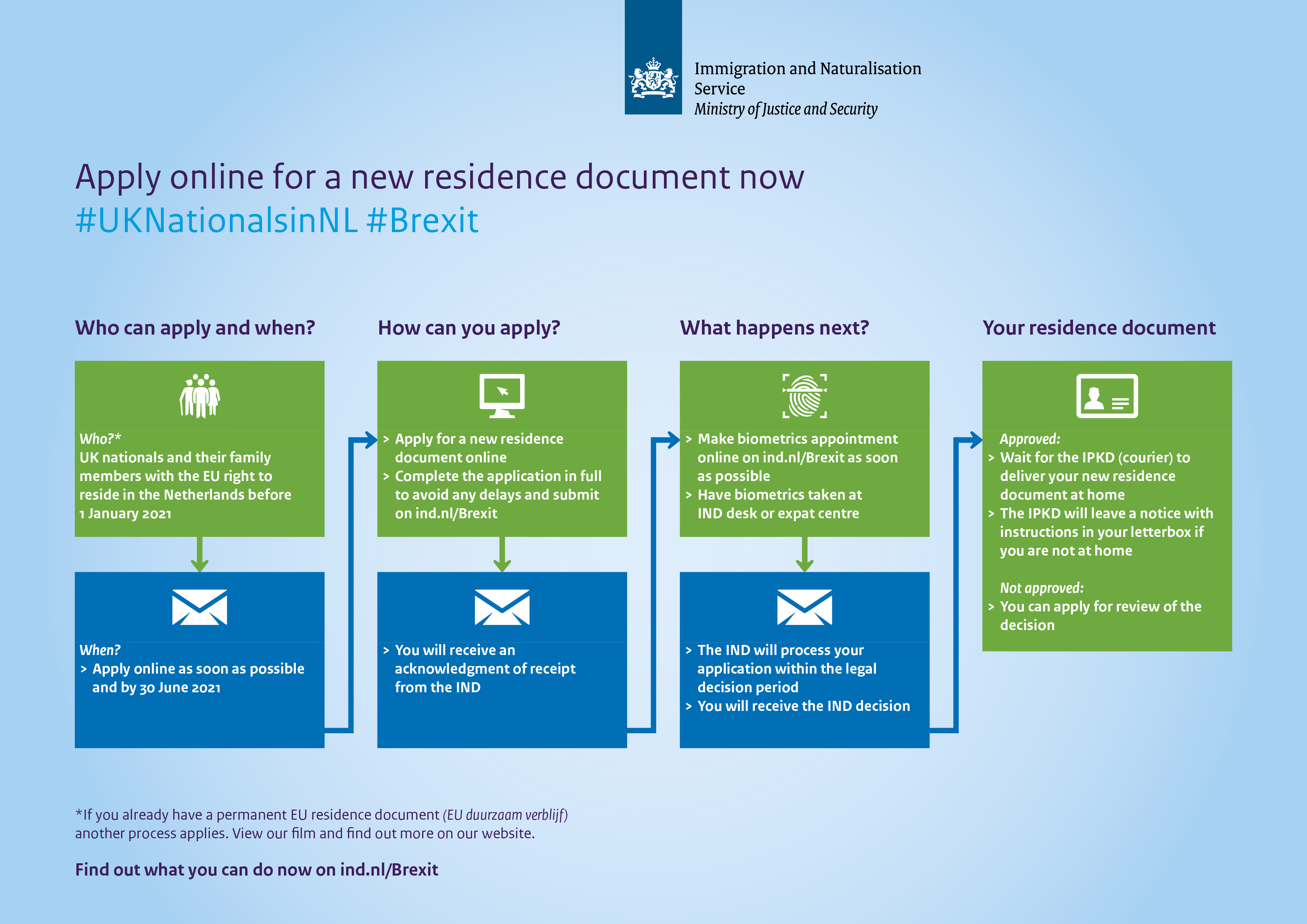

British citizens in the Netherlands

Are you from the UK and living in the Netherlands? If you were established in Holland before Brexit, your case falls under the withdrawal agreement. Hence you can stay in the Netherlands, but you must apply for a residence permit at the Dutch Immigration and Naturalisation Service (IND). Also if you want to move to the Netherlands after Brexit, check the IND link above. Your application for residence will be measured against standards about your situation and purposes. The Brexit homepage of the IND helps you to gain more insight on this.

Suggested reading on the Brexit agreement

In documents of the European Commission you can do extensive reading on the Brexit agreement. The ‘Brexitloket’ and Brexit impact scan from the Dutch government are great starting points to figure out what Brexit means for your business, if you are able to understand Dutch. Also in Dutch: the Chamber of Commerce published a useful overview of the consequences of Brexit on VAT-tariffs. The British government provides for a Brexit checker that will give you a personalised list of actions you might have to undertake as a consequence of Brexit.

Lexlupa is a multidisciplinary effort of fiscal, legal and economic experts. We give advice and guidance to companies, institutions and private individuals at life events. Lexlupa helps you to make well-informed choices in business and personal affairs, and we support you in managing your business in the best possible way.