Planning to work for yourself? Will you be classed as an entrepreneur?

Update: 2024

This article aims to clarify whether you will be seen as an entrepreneur by the tax authorities, or whether your activities could be considered salaried employment. The law that regulates this distinction, the DBA, has been under fire for years, because the criteria are said to be too vague. This lack of clarity has meant that a clear dichotomy is not possible. For this reason there has been no active enforcement of the DBA for 8 years. At the time of writing (October 2024), a new bill has been set before the Council of State. This new bill the (VBAR), will most likely become the new standard used for assessing employment relationships and will succeed the DBA from 2026. As of 2025 up until 2026 the DBA will be brought back into force for determining whether employment relationships are valid cases of self employment or are in fact disguised employment.

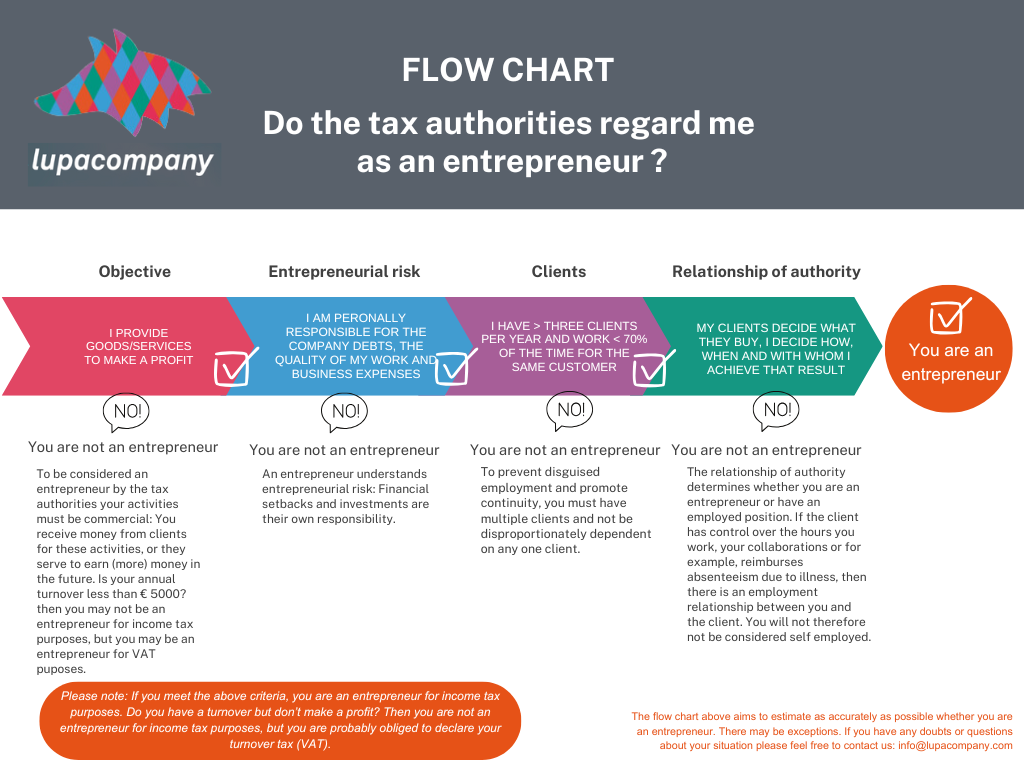

Lupacompany has created the following flowchart to help you determine whether your work falls within the criteria of self-employment, or is classified as (disguised) paid employment:

)