Building up a pension as an entrepreneur in The Netherlands?

These are the actual costs of an annuity policy

While employees accrue pension through their employer, as an entrepreneur you have to arrange such a source of income yourself. If you take out an annuity policy, you set aside money to be refunded later as a benefit on top of your AOW. With a number of advantages, banks, insurers and the government are trying to make this option attractive. But the disadvantages are often communicated less clearly. That is why we dived into the small print and listed the actual costs of 5 large providers.

Please note that most online information, terms and conditions of Dutch annuity policies are not available in English. If you need any help reading the websites linked in this article, or the Dutch schemes below, don’t hesitate to contact us. We are happy to help.

Tax advantage

Before we go into the costs of the various policies, we first look at the tax arrangements around pension accrual by means of an annuity. As mentioned, there are a number of interesting advantages to taking out an annuity policy. An important tax advantage is that the investment is fully deductible in income and corporate income tax. But when taking out a policy, keep in mind that the payment of the annuity is taxed. On balance, therefore, less remains than the deposit. The unpaid tax can be seen as a deferred tax obligation.

Yield

An advantage of an annuity policy is the positive return that most providers of annuity products offer. For example, taking out an annuity policy seems like an attractive way to grow your capital. But this return does not always outweigh the inflation that occurs in the years of investment and the cost of the policy. For example, there are almost always closing costs and costs for management. Investment institutions can also charge costs of the funds and it is possible that providers (will) calculate a negative return. In addition, you cannot access your money until the agreed end date. If you need it earlier, you pay a tax penalty and a lump sum to the providers. Finally, when investing savings, there is often a higher return to be achieved, but at the same time the well-known risk that you lose (part of) your investment.

It is therefore important that you - before you take out an annuity policy - not only look at gross return, but you are well informed to see what return actually remains. As promised: for 5 policies, we have done the research for you, completely independent and transparent.

-

Brand New Day*

Retirement account investing

Brand New Day offers entrepreneurs the opportunity to build up pension with retirement account investing. The average return indicated at the time of writing (April 2022) is no less than 6%. Considerably more than in an average savings account. And the cost of management is zero. Not bad. But in order to find out what can realistically be achieved for return, we had to go deep through the product conditions of the policy. This study lists our findings:

Gross return (average, April 2022): 6%

One-time fee: 45

Management: 0

But most fees are different periodic percentages on deposits and deposits:

0.50% deposit fee

0.34% service fee

0.15 to 0.17% fund fee per year

In addition, rates can always change (unless agreements have been made for a fixed fee for a fixed period) and as with any investment policy: returns are always example scenarios. The actual final capital may differ from the often-rosy calculation examples. In practice, returns are never guaranteed.

Finally, what is striking is that Brand New Day is not very transparent with regard to costs for the premature termination of the agreement. In the communication there is a very strong emphasis on regaining part of the annual space by the tax authorities and nuance with regard to the risks and costs is somewhat far away.

*) As of April 1, 2021, Brand New Day has been acquired by a.s.r. . The pension products will continue to be available under the name Brand New Day.

2. Rabo Future Investing

At Rabobank, we didn't have to dig as deep for snags and poorly visible price tags. In a separate folder, the (possible) costs of pension accrual are neatly listed.

At Rabo future investments, costs on the invested capital are charged quarterly for basic services and for fund management. These are summarized as follows:

|

BASIC SERVICES |

|

|

Up to €100.000 |

0,06% |

|

€100.000 – €500.000 |

0,03% |

|

€500.000 - €2.000.000 |

0,01% |

|

> €2.000.000 |

0,0025% |

For basic services you pay at least € 5 per quarter. The costs for services are not subject to VAT.

|

PORTFOLIO MANAGEMENT |

|

|

Up to €100.000 |

0,1% |

|

> €100.000 |

0,09% |

The costs for portfolio management include 21% VAT.

In addition to these costs, Rabobank says, the funds themselves also charge a rate for their services. On average, this rate is about 0.15% per year.

In addition, Rabobank charges a one-off amount of €35 for the opening of Future Investments, and a Rabobank payment account is required to build up a pension in this way. This account is also subject to costs.

As we can see, the gross return that can be achieved on Rabo future investments is reduced to a number of costs. In a calculation example, the bank shows that with an imaginary return on investments of 4% (i.e. 2% lower than the proposed return of Brand New Day), a gross return of € 200 is achieved on a one-off investment of € 5,000 after one year. Net of this (after deduction of the above costs) € 143 remains.

Obviously, the fictitious return of 4% is not guaranteed.

-

Rabo Future Savings

Rabobank offers more certainty about your return when building up your pension with the Future Savings product. But here too, no guarantees are given about the return to be achieved: From 6 October 2021, you can only open a new Rabo ToekomstSparen account with variable interest. At the time of writing (April 2022) this is 0.2%. Future returns are therefore not guaranteed on a savings account either. For current interest rates, go to www.rabobank.nl/toekomstsparen (in Dutch only).

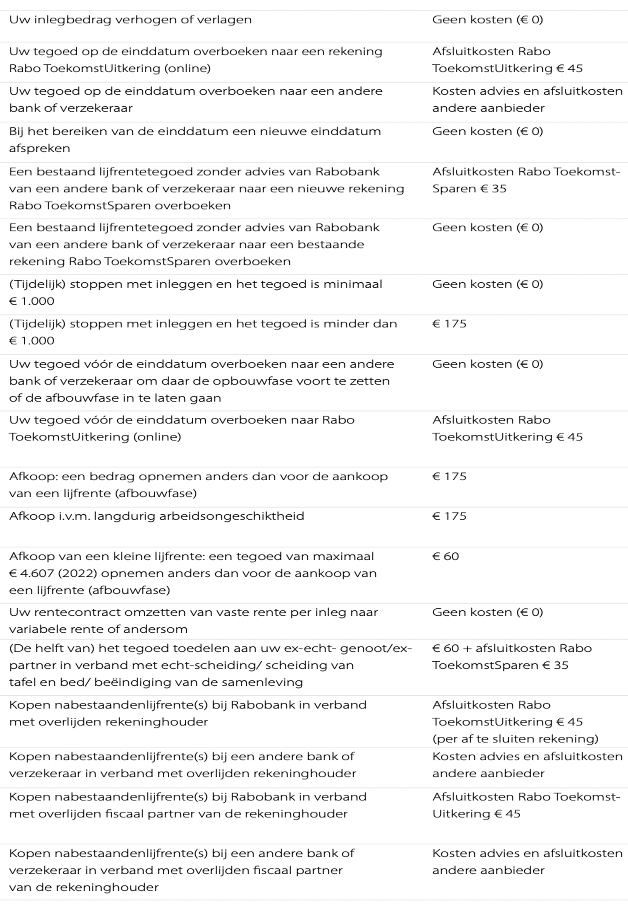

For Rabo Future Savings, you will pay €35 one-off closing costs in 2022. Costs for the use of services such as internet banking are included in the interest rate. These are therefore not invoiced separately or deducted from your credit. However, there are various circumstances in which additional costs are charged. Rabobank has listed these in the (Dutch only) diagram below:

Source: Rabobank

The final interest to be received on the accumulated balance is - if percentages fluctuate during the term - a so-called average interest rate: the average of different rates over different deposits is calculated, added to the savings account at the end of the year.

-

Nationale Nederlanden

Supplementary Pension Accrual

You can also build up a pension at Nationale Nederlanden as an entrepreneur. Unlike Rabobank, you can choose between fixed or variable interest rates. The fixed interest rate depends on the term. With a minimum of 1 year of 0.05% interest and a maximum of 30 years of 0.95%. Variable interest is of course variable. At the time of writing (April 2022), the variable return is 0.1%. Current returns can be found on the website in the pdf under the heading 'rente'.

Costs

When applying for the bill, you pay a one-off distribution fee of € 50 (via nn.nl) or € 125 (if you request by telephone).

In the product conditions we read more about costs. We do not find fixed costs, but we do find a complex formula for the costs of redeeming the policy and a broad reservation on possible future costs:

10.2 If you terminate a deposit before the end of the term, we will charge a withdrawal fee.

We calculate the withdrawal costs using:

(R): the interest rate of a new deposit minus the interest rate of your current deposit.

(S): the balance of your deposit.

(L): the number of years you end your deposit earlier.

We calculate the withdrawal costs as follows:

R x Sx L

10.3 We may adjust the amount of the costs or charge other costs. If we do, you will receive a message from us a month in advance.

Just like Nationale Nederlanden, ING also gives a return on their pension savings account which depends on the term of the policy: Return Fixed return is 0.01% after 2 months, and 1.50% after 30 years

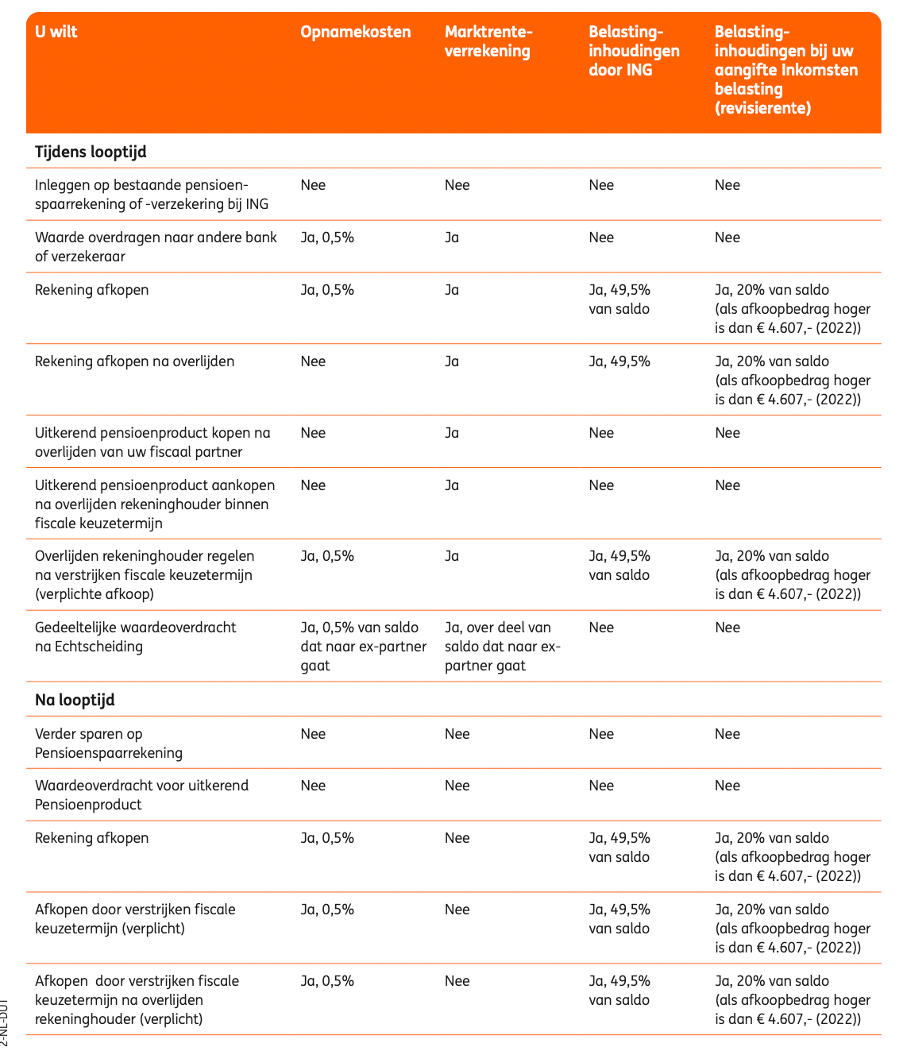

When it comes to the costs associated with the policy, ING is pleasantly transparent. We found the following schedule with costs (unfortunately, again, in Dutch only):

Scheme: ing.nl

Want to know more about accruing pension?

You will have seen that arranging a potty for later in a profitable and safe way requires the necessary deepening. There are plenty of providers with as much fine print that you don't want to overlook. The last thing you want is to get stuck with a usury policy, or eventually suffer financially. To arrange an annuity in the best possible way, you can, for example, read up on the site of the Tax Authorities, and / or check comparison sites. Lexlupa provides independent advice and thinks along when it comes to insurance and other tax, legal and strategic choices as an entrepreneur.

Lexlupa stands for a multidisciplinary use of tax, legal and economic expertise. We provide advice and guidance to companies, institutions and individuals at 'life events' . Lexlupa helps to make well-informed choices and to arrange things in the right way.